You will need a license to become a Pennsylvania real-estate agent. There are many things to consider such as education, experience and background. It is important to consider the cost of a license in real estate.

Your prelicensing class is the first step in obtaining your PA real-estate license. This course prepares you for the PA real-estate exam. This is the fastest way to get your license. However, it can also be the most time-consuming. Prelicensing is not enough. You also have to pass a criminal history check. All of your education and work history, as well as contact information, will be required.

PSI administers the real estate license exam. You will need to answer 110 questions when you take the exam. These questions can be answered in 120 minutes. Most of these questions relate to the Regulations of Conduct of Licensees. But, there's also a Pennsylvania section. These 30 questions are based in local laws.

It is important that you have a broker recommendation you to the Pennsylvania Real Estate Commission. Your recommendation should include the name, license number, company, and contact information of the broker. Although the broker might not be the applicant for the license it is a good idea that you have the recommendation before you take the exam.

You can also consider using an exam prep package to help you study for the PA real estate exam. This can be a risk-free way to practice before you sit for the test. A reputable prep program should provide you with practice questions and test answers.

Aceable Agent is one the most popular exam prep programs. Aceable Agent is an online course that will teach you about different career options in real-estate. Their team of experts is comprised of NASA, Harvard, and MIT experts, so you can be confident that you will receive quality instruction. The pass rates of the company on the exam are among the best in the industry.

The second part of obtaining your Pennsylvania real estate license is to complete a state-specific background check. You can obtain a Pennsylvania criminal history check on your own but it can be expensive up to $22

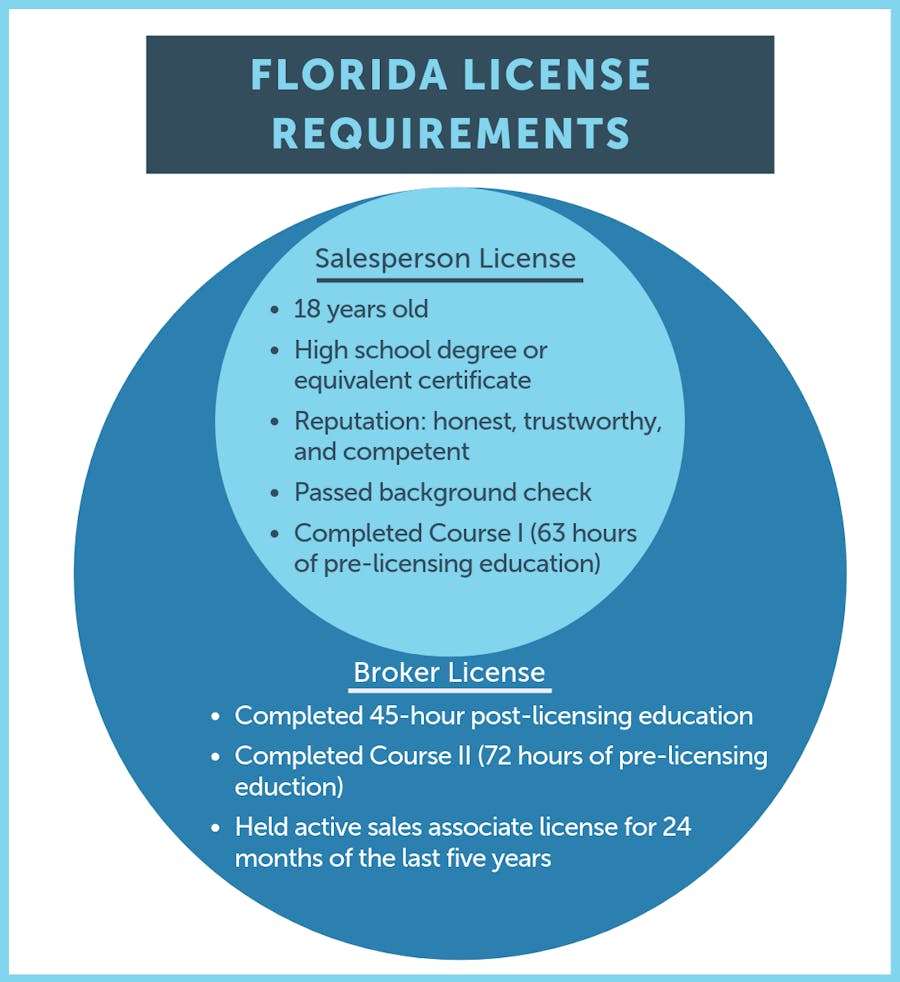

You must be at least 18 to become a Pennsylvania real-estate agent. A licensed real-estate broker may sponsor applicants who are under 18 years of age to get a license. In order to be eligible for a license, you will need to show that you have either a high school diploma (or an equivalent credential). Additionally, you should ensure that your support system is in place. For example, a professional resource for marketing.

Assuming you have completed the course, you will need to pass the PA real estate licensing exam. Although passing the exam is the first step in earning your license you will need continue education.

FAQ

How much should I save before I buy a home?

It depends on the length of your stay. Start saving now if your goal is to remain there for at least five more years. But if you are planning to move after just two years, then you don't have to worry too much about it.

How much will my home cost?

It depends on many factors such as the condition of the home and how long it has been on the marketplace. Zillow.com shows that the average home sells for $203,000 in the US. This

How long does it take for a mortgage to be approved?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

How do you calculate your interest rate?

Market conditions influence the market and interest rates can change daily. The average interest rate over the past week was 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

Can I buy a house without having a down payment?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include conventional mortgages, VA loans, USDA loans and government-backed loans (FHA), VA loan, USDA loans, as well as conventional loans. Visit our website for more information.

What should you look for in an agent who is a mortgage lender?

People who aren't eligible for traditional mortgages can be helped by a mortgage broker. They shop around for the best deal and compare rates from various lenders. Some brokers charge fees for this service. Others offer free services.

How long does it take to sell my home?

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It can take anywhere from 7 to 90 days, depending on the factors.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

How to Find an Apartment

Finding an apartment is the first step when moving into a new city. Planning and research are necessary for this process. This involves researching and planning for the best neighborhood. There are many ways to do this, but some are easier than others. Before renting an apartment, you should consider the following steps.

-

You can gather data offline as well as online to research your neighborhood. Online resources include Yelp. Zillow. Trulia. Realtor.com. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

Find out what other people think about the area. Yelp, TripAdvisor and Amazon provide detailed reviews of houses and apartments. You might also be able to read local newspaper articles or visit your local library.

-

For more information, make phone calls and speak with people who have lived in the area. Ask them what they loved and disliked about the area. Ask for their recommendations for places to live.

-

Check out the rent prices for the areas that interest you. Renting somewhere less expensive is a good option if you expect to spend most of your money eating out. On the other hand, if you plan on spending a lot of money on entertainment, consider living in a more expensive location.

-

Find out information about the apartment block you would like to move into. For example, how big is it? How much does it cost? Is it pet-friendly? What amenities is it equipped with? Do you need parking, or can you park nearby? Are there any rules for tenants?